avermaster.ru Overview

Overview

How To Get A Bank To Finance A House

If there isn't enough cash available, you may choose to finance these improvements by going to your bank or other lender and apply for a loan. During the. But when you get the one-time close construction loan, you won't have to apply for financing, pay closing costs, or go through the closing process again after. Wells Fargo Home Mortgage offers competitive rates on a variety of home loan options. Visit Wells Fargo today to check rates and get mortgage financing. Many financial institutions offer this type of loan, which lets you borrow money for a down payment while you wait on the sale of your home. Keep in mind that. Step 2 Complete your mortgage application · Income statements, such as pay stubs or award letters. · Current bank statements. · Other supporting documents as. Wherever you are in your homebuying journey, Wells Fargo can help guide you through the mortgage process. Find home loan options and get the support you. 1. Know how much cash you'll need at closing. · 2. Budget for private mortgage insurance. · 3. Research your utilities. · 4. Don't forget miscellaneous expenses. Financial Insights · About Us · Customer Service · Branch & ATM Locator · Home · Borrow; Mortgages. Home Mortgage Loans. Fifth Third Bank can help you get. Federal Housing Administration (FHA) insures mortgage loans made by private lending institutions to finance the purchase of a new or used manufactured home. If there isn't enough cash available, you may choose to finance these improvements by going to your bank or other lender and apply for a loan. During the. But when you get the one-time close construction loan, you won't have to apply for financing, pay closing costs, or go through the closing process again after. Wells Fargo Home Mortgage offers competitive rates on a variety of home loan options. Visit Wells Fargo today to check rates and get mortgage financing. Many financial institutions offer this type of loan, which lets you borrow money for a down payment while you wait on the sale of your home. Keep in mind that. Step 2 Complete your mortgage application · Income statements, such as pay stubs or award letters. · Current bank statements. · Other supporting documents as. Wherever you are in your homebuying journey, Wells Fargo can help guide you through the mortgage process. Find home loan options and get the support you. 1. Know how much cash you'll need at closing. · 2. Budget for private mortgage insurance. · 3. Research your utilities. · 4. Don't forget miscellaneous expenses. Financial Insights · About Us · Customer Service · Branch & ATM Locator · Home · Borrow; Mortgages. Home Mortgage Loans. Fifth Third Bank can help you get. Federal Housing Administration (FHA) insures mortgage loans made by private lending institutions to finance the purchase of a new or used manufactured home.

Find a home in your budget · Generate home affordability scenarios based on your actual budget information. · Get a clear view of your spending habits and adjust. Many financial institutions offer this type of loan, which lets you borrow money for a down payment while you wait on the sale of your home. Keep in mind that. Our off-site monitoring program includes reviews of monthly and quarterly financial reports and information submitted to FHFA, FHLBank board and committee. Your credit score shows you have a proven history of making payments on time and that you're less of a risk. In these instances, they might allow you to get a. You need to meet with a mortgage broker at a bank or brokerage to get an idea of what they will lend you. Since the amount you want to put down. Not all home loans are the same. Knowing what kind of loan is most appropriate for your situation prepares you for talking to lenders and getting the best. How to get your finances in order before applying for a mortgage · Select breaks down how to prepare your credit score and savings to begin the homebuying. How to buy a fixer-upper house. The process of buying a home with a fixer-upper loan is similar to financing a traditional house, with a few extra steps. Start with small steps for your big investment. Learn about your options and what to expect when you buy or refinance a home. When you're ready, we'll match you. Contact Navy Federal at , Option 1, to check your eligibility and current rates. Navy Federal will only reduce the interest rate of a Covered Loan. Explore U.S. Bank's mortgage loans and start your home mortgage process today. Compare mortgages, see current rates, calculate monthly payments and more! The Bank of America Digital Mortgage Experience® puts you in control. Prequalify to estimate how much you can borrow, or apply (and get pre-approved) for a new. Sometimes, the property simply has a few features the seller knows a bank wouldn't approve of, but they don't want to put the money into fixing it. If you've. If there isn't enough cash available, you may choose to finance these improvements by going to your bank or other lender and apply for a loan. During the. Do you need mortgage loans at low-interest rates? Explore competitive mortgage interest rates for home loans and get started in applying for a mortgage. The money you're borrowing from the bank (which is your mortgage) will need to be repaid with interest and in exchange, you'll get to occupy the home and. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. Seamless Financing for Lennar Homes As Lennar's affiliated lender, we provide a streamlined experience designed for new construction homes. In alone, we. arrange an overseas mortgage with your local bank. apply for a mortgage from an overseas lender. release equity from your home, if you already own property. pay. Mortgage loans are available from different types of lenders, including credit unions, banks, and online lenders. However, it's always smart to start the.

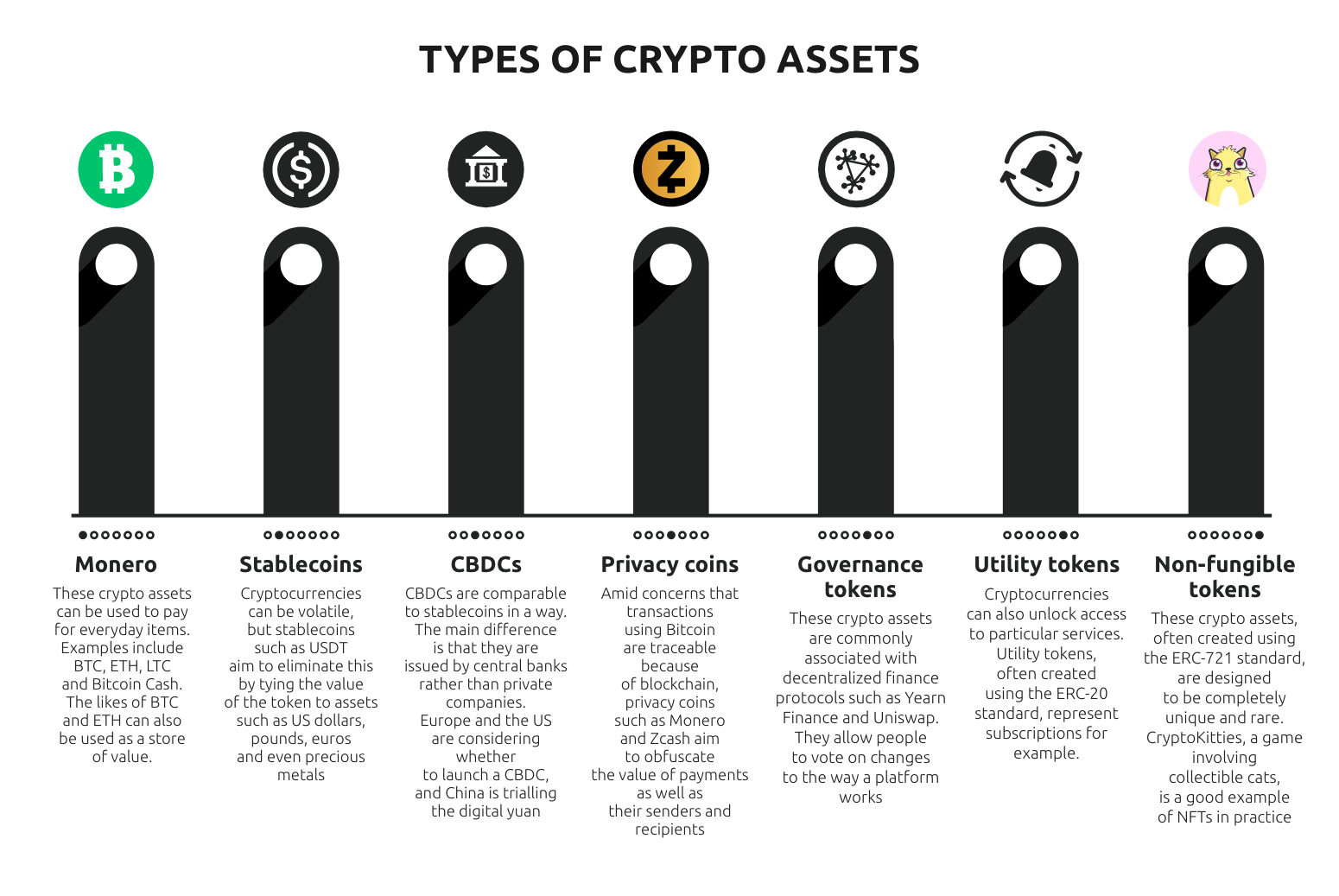

What Is The Meaning Of Crypto

A cryptocurrency is an encrypted data string that denotes a unit of currency. It is monitored and organized by a peer-to-peer network called a blockchain. Cryptocurrency is a type of virtual currency built around transparency and inclusion. Unlike traditional currencies, cryptocurrencies exist as a digital. adjective. secret or hidden; not publicly admitted: a crypto Nazi. a combining form meaning “hidden,” “secret,” used in the formation of compound words. Crypto is a digital currency, meaning it runs on a virtual network and doesn't exist in physical form like paper money or coins. Cryptocurrencies are often. Cryptocurrency is a digital form of currency that uses cryptography to secure the processes involved in generating units, conducting transactions and. Crypto is a digital currency, meaning it runs on a virtual network and doesn't exist in physical form like paper money or coins. Cryptocurrencies are often. 4 meanings: informal 1. → short for cryptocurrency 2. a person who conceals his or her membership of a political group a. Click for more definitions. First, let's discuss what we mean when we talk about “crypto assets.” They include cryptocurrencies, tokens, coins, non-fungible tokens (aka NFTs), stablecoins. Crypto- is a combining form used like a prefix meaning “hidden, secret.” It is used in many scientific, medical, and other technical terms. A cryptocurrency is an encrypted data string that denotes a unit of currency. It is monitored and organized by a peer-to-peer network called a blockchain. Cryptocurrency is a type of virtual currency built around transparency and inclusion. Unlike traditional currencies, cryptocurrencies exist as a digital. adjective. secret or hidden; not publicly admitted: a crypto Nazi. a combining form meaning “hidden,” “secret,” used in the formation of compound words. Crypto is a digital currency, meaning it runs on a virtual network and doesn't exist in physical form like paper money or coins. Cryptocurrencies are often. Cryptocurrency is a digital form of currency that uses cryptography to secure the processes involved in generating units, conducting transactions and. Crypto is a digital currency, meaning it runs on a virtual network and doesn't exist in physical form like paper money or coins. Cryptocurrencies are often. 4 meanings: informal 1. → short for cryptocurrency 2. a person who conceals his or her membership of a political group a. Click for more definitions. First, let's discuss what we mean when we talk about “crypto assets.” They include cryptocurrencies, tokens, coins, non-fungible tokens (aka NFTs), stablecoins. Crypto- is a combining form used like a prefix meaning “hidden, secret.” It is used in many scientific, medical, and other technical terms.

Bitcoin is a cryptocurrency, which is to say a type of digital currency. Unlike traditional currencies - the dollar or pound, for example - Bitcoin is not. An altcoin refers to a cryptocurrency other than Bitcoin. Each has its own set of rules, properties, and specific use cases. Altcoins could be completely new. A blockchain is a decentralized, distributed and public digital ledger that is used to record transactions across many computers so that the record cannot be. Crypto slang for a large quantity of a specific cryptocurrency. Alternatively (but less frequently) used to refer to the contents of an individual's crypto. A cryptocurrency is a digital currency, which is an alternative form of payment created using encryption algorithms. The use of encryption technologies means. Instead, cryptocurrencies are created, exchanged, and often overseen by a distributed peer-to-peer network. Crypto is digital, meaning two things. First, with a. Cryptocurrency Meaning. A type of digital asset known as cryptocurrency relies on a network that is dispersed among numerous computers. They are able to exist. A blockchain is a decentralized ledger of all transactions across a peer-to-peer network. Using this technology, participants can confirm transactions without a. secret or hidden; not publicly admitted:a crypto Nazi. Cryptographya combining form meaning "hidden,'' "secret,'' used in the formation of compound words. A “token” often refers to any cryptocurrency besides Bitcoin and Ethereum (even though they are also technically tokens). · The other increasingly common meaning. A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant. At its core, cryptocurrency is typically decentralized digital money designed to be used over the internet. Bitcoin, which launched in , was the first. Cryptocurrency trading explained. Crypto trading is the act of Both are leveraged products, meaning you only need to put up a small deposit. Blockchain · Cryptocurrency · Crypto Exchange · Digital Currency · Digital Wallet · Fiat Currency · Metaverse · Non-fungible Token (NFT). Digital Currency. Digital currencies, or cryptocurrencies, are electronic tokens generated by networks of computers to replace traditional currencies. Paying. The meaning of the word crypto as an abbreviation is controversial. Cryptographers - people who specialize in cryptography - have used the term "crypto" as. Assets that are verified and stored using blockchain technology but are nonfungible, meaning they are unique and can't be replaced with something else. The. A slang term used within the crypto community meaning to steadfastly hold on to your crypto assets especially through big price dips. Hodling is a mentality. What are Cryptocurrencies? Cryptocurrencies are digital tokens. They are a type of digital currency that allows people to make payments directly to each. For example, ETH is the native token of the Ethereum blockchain. Any other cryptoassets that exist on the Ethereum blockchain are tokens. What is the difference.

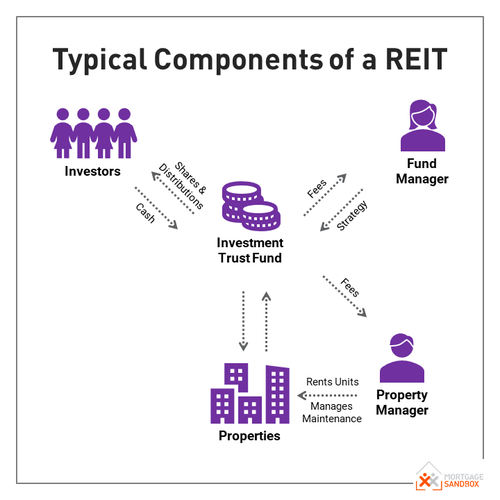

How Do Reits Work

REITs often make great passive income investments Congress created REITs so that anyone could own income-producing real estate. REITs must pay a dividend. How Do REITs Work? REITs typically focus on a particular category of commercial real estate. Diversified and specialty REITs, on the other hand, could include a. How do REITs work? REITs exist to provide unitholders with stable and growing cash distributions, typically payable monthly, from investments in a. A real estate investment trust (REIT) is a company that owns and operates income-producing real estate assets to generate revenue. Many investors may have some exposure to REITs through diversified mutual funds and ETFs. Those who want to further diversify their portfolios with REITs should. How It Works A typical REIT structure works like this: Money is raised from unit holders through an Initial Public Offering (IPO) and used by the REIT to. REITs allow investors to pool their money and buy properties together in order to get exposure to the potential benefits of ownership. A real estate investment trust (REIT) is a company that invests in and finances property 1. Like a standard actively managed investment fund, it enables. A REIT is a company that owns and typically operates income-producing real estate or related assets. These may include office buildings, shopping malls. REITs often make great passive income investments Congress created REITs so that anyone could own income-producing real estate. REITs must pay a dividend. How Do REITs Work? REITs typically focus on a particular category of commercial real estate. Diversified and specialty REITs, on the other hand, could include a. How do REITs work? REITs exist to provide unitholders with stable and growing cash distributions, typically payable monthly, from investments in a. A real estate investment trust (REIT) is a company that owns and operates income-producing real estate assets to generate revenue. Many investors may have some exposure to REITs through diversified mutual funds and ETFs. Those who want to further diversify their portfolios with REITs should. How It Works A typical REIT structure works like this: Money is raised from unit holders through an Initial Public Offering (IPO) and used by the REIT to. REITs allow investors to pool their money and buy properties together in order to get exposure to the potential benefits of ownership. A real estate investment trust (REIT) is a company that invests in and finances property 1. Like a standard actively managed investment fund, it enables. A REIT is a company that owns and typically operates income-producing real estate or related assets. These may include office buildings, shopping malls.

Rental income: The REIT earns rental income from its properties, which is distributed to shareholders as dividends. REITs are required by law to distribute at. On a practical level REITs work in much the same way stocks do. Shares in REITs are usually listed on exchanges and can be traded by market participants. The. Equity REITs primarily own and operate income-producing properties, while mortgage REITs invest in mortgages or mortgage-backed securities. Hybrid REITs combine. REITs are regulated investment vehicles that enable collective investment in real estate, where investors pool their funds and invest in a trust with the. REITs are a type of company that owns and operates real estate. They are tax advantaged in certain ways vs. other types of companies. There are. Real Estate Investment Trust (REIT) · How Does a REIT Work? REITs can invest in all property types, although most specialize in specific property types. · Why. How do REITs work? REITs are required by law to distribute a significant portion of their taxable income to shareholders in the form of dividends. To. REITs are publicly traded companies that own, operate or finance real estate. REITs pool funds from individual investors and use those funds to build a. REITs offer motivated investors the benefits of real estate investment without the hassle of owning actual properties. In turn, investors receive dividends. REITs simplify state tax reporting for individuals since the state income tax consequences and filing requirements of multistate real estate portfolios do not. REITs or Real Estate Investment Trust is a company that owns, operates, or finances income-producing real estate properties. A real estate investment trust is a company that owns, operates, or finances income-generating real estate. Most REITs have a direct plan of action: The REIT leases space and gathers leases on the properties, at that point appropriates that salary as profits to. Equity REITs allow investors to access large-scale, diverse portfolios of income producing properties and assets that they would not otherwise be able to access. Real Estate Investment Trust - REITs are corporations that manage the portfolios of high-value real estate properties and mortgages. The Keys to Assessing Any REIT · REITs are true total-return investments. · Unlike traditional real estate, many REITs are traded on stock exchanges. REITs are funds that invest in a portfolio of income-generating real estate assets such as shopping malls, offices, hotels and industrial properties with. Similar to mutual funds, REITs allow investors to pool their money and buy properties together in order to get exposure to the potential benefits of ownership. REITs offer motivated investors the benefits of real estate investment without the hassle of owning actual properties. In turn, investors receive dividends. Many investors seeking passive income choose to invest in real estate investment trusts (REITS). REITs are companies that are funded by investors and tasked.

Canadian Sports Betting App

Below, we're providing you with a breakdown of the best Canadian betting apps so you can enjoy your mobile experience with the top bookmakers around. NEW: Download the Betway Sports Android App Today (APK). The Betway Sports Canada App is safe and reliable & comes from a verified source. The best sportsbooks in Canada also tend to offer the best sports betting apps in Canada, including bet, LeoVegas, Pinnacle, Betway, Bet99 and BetVictor. DraftKings Sportsbook offers dozens of American, Canadian, and international sports for users to bet on. Bet with DraftKings Sportsbook. App. Sports Betting Bonuses and Promotions in Canada ; 1. Betovo · Deposit $, Play with $ · Betovo Review ; 2. LeoVegas · $50 In Free Bets When You Bet $ Of all of the betting apps currently available in Canada, the best betting apps in Canada are Betway, Bet, PointsBet, and Caesars Sportsbook. These apps are. theScore Bet is an award-winning sportsbook that is uniquely integrated with theScore, allowing you to seamlessly navigate between the betting app and real-time. TonyBet is a familiar name among Canadian sports bettors, and for a good reason. This betting app packs a serious punch with thousands of daily betting markets. Dedicated Mobile App: FanDuel Sportsbook provides a dedicated mobile app that allows you to bet on your favorite sports conveniently from anywhere in Canada. Below, we're providing you with a breakdown of the best Canadian betting apps so you can enjoy your mobile experience with the top bookmakers around. NEW: Download the Betway Sports Android App Today (APK). The Betway Sports Canada App is safe and reliable & comes from a verified source. The best sportsbooks in Canada also tend to offer the best sports betting apps in Canada, including bet, LeoVegas, Pinnacle, Betway, Bet99 and BetVictor. DraftKings Sportsbook offers dozens of American, Canadian, and international sports for users to bet on. Bet with DraftKings Sportsbook. App. Sports Betting Bonuses and Promotions in Canada ; 1. Betovo · Deposit $, Play with $ · Betovo Review ; 2. LeoVegas · $50 In Free Bets When You Bet $ Of all of the betting apps currently available in Canada, the best betting apps in Canada are Betway, Bet, PointsBet, and Caesars Sportsbook. These apps are. theScore Bet is an award-winning sportsbook that is uniquely integrated with theScore, allowing you to seamlessly navigate between the betting app and real-time. TonyBet is a familiar name among Canadian sports bettors, and for a good reason. This betting app packs a serious punch with thousands of daily betting markets. Dedicated Mobile App: FanDuel Sportsbook provides a dedicated mobile app that allows you to bet on your favorite sports conveniently from anywhere in Canada.

PowerPlay is a new entrant to the sports betting market in Canada. This betting app is loaded with a variety of sports betting events from across the globe. Yes, sports betting is legal in Canada. In August , Canadian lawmakers amended the nation's criminal code via bill C to allow single-game sports betting. sport betting odds delivers the best of the latest sports coverage of NFL odds, NBA odds, MLB odds, UFC odds and much more with its extensive markets. Savvy Canadian bettors have opened their dooryards to reputable betting sites, but it remains a mystery whether the Atlantic Lottery Corporation will. The best and most trusted sports betting apps in Canada are Sports Interaction, Betway, bet, Parimatch, and BetVictor. Is betting legal in. A crucial part in ensuring you are maximizing your winning potential on your hockey bets is by downloading the sports betting app connected to your preferred. Yes, as of April 4, online sports betting is legal in Ontario. A limited form of sports betting was legal in Canada for several decades. The only way. Another popular sports betting option in Canada is Betway. This internationally recognized platform offers a comprehensive selection of sports to bet on. DraftKings Sportsbook offers dozens of American, Canadian, and international sports for users to bet on. Bet with DraftKings Sportsbook. App. The best Canadian sports betting sites provide large bonuses, reliable payouts and competitive odds on leagues such as the NHL, CFL and NBA. Bet99 App. Bet99 is one of the emerging betting apps that is catching the eyes of Canadians around the country. This mobile option is known for its world-. Of our top recommended providers, Android and iOS betting apps are available from Betsafe, Betway, bet, BetVictor & ComeOn! for use in Canada. Betting app. Bet99 starts as our top online betting site in January Offering a fantastic online betting site and mobile betting app, Bet99 ticks many boxes for new. Betway is a well-known Canadian online sports betting company. The app allows plenty of opportunities to make money via online sports betting. Betway Canada. We've compiled a list of the best Canadian sports betting apps. Features our experts look out for when evaluating the best betting apps include user-. Yes, single-game sports betting is legal in Canada. Sports betting has been legal since thanks to Bill C That said, each province will still have its. This app is available for users in Ontario only. Not in Ontario? No problem! Download our Out of Store app via this link. Proline+ Sportsbook App: Officially Licensed Canadian Betting Proline+ is the official sports betting app of the Ontario Lottery and Gaming Corporation (OLG). betting app today. None of Sign up today and start placing your bets with any of the top online Canadian casinos found here at Canadian Sports Betting.

Straight Talk Phone T Mobile Sim Card

Straight Talk SIM Card Verizon, T-Mobile, 4G LTE & 5G Plus Bonus Sim Tool · $ to $ · 1, sold ; Straight Talk Keep Your Own Phone SIM Kit for Unlocked. Get ATT micro sim card for Straight Talk. Put it in the phone, under settings, more network, there is an APN menu and you just type in the info that comes in. Also known as a bring your own phone (BYOP) or keep your own phone kit, This activation kit converts your T-Mobile phone or unlocked GSM phone into a. The SIM card-only with “bring your own phone” is sold exclusively at Walmart (Store finder), including the monthly combo plans for 30 days: $ unlimited talk. Activating Your Plan · Enter the IMEI/MEID number on the red activation card, if you bought the phone from TracFone. · Enter the last digits of your new SIM. Browse common support topics for your prepaid phone. Navigate topics such as account management, phones, services, airtime, and more at Straight Talk. Bring your own phone when you switch to Straight Talk with this SIM card kit. Verizon compatible. Works with most compatible or unlocked CDMA phones. If your device only supports a physical SIM card, we'll send it to the address you provided during sign up for free! Just follow the included steps to finish. Switch to Straight Talk's prepaid plan with a SIM card kit for your phone and enjoy unlimited talk, text, and data on America's most reliable 5G network. Straight Talk SIM Card Verizon, T-Mobile, 4G LTE & 5G Plus Bonus Sim Tool · $ to $ · 1, sold ; Straight Talk Keep Your Own Phone SIM Kit for Unlocked. Get ATT micro sim card for Straight Talk. Put it in the phone, under settings, more network, there is an APN menu and you just type in the info that comes in. Also known as a bring your own phone (BYOP) or keep your own phone kit, This activation kit converts your T-Mobile phone or unlocked GSM phone into a. The SIM card-only with “bring your own phone” is sold exclusively at Walmart (Store finder), including the monthly combo plans for 30 days: $ unlimited talk. Activating Your Plan · Enter the IMEI/MEID number on the red activation card, if you bought the phone from TracFone. · Enter the last digits of your new SIM. Browse common support topics for your prepaid phone. Navigate topics such as account management, phones, services, airtime, and more at Straight Talk. Bring your own phone when you switch to Straight Talk with this SIM card kit. Verizon compatible. Works with most compatible or unlocked CDMA phones. If your device only supports a physical SIM card, we'll send it to the address you provided during sign up for free! Just follow the included steps to finish. Switch to Straight Talk's prepaid plan with a SIM card kit for your phone and enjoy unlimited talk, text, and data on America's most reliable 5G network.

No, it will not work, New Straight Talk phones are locked to Straight Talk service. Upvote.

Talk and text to Mexico & Canada while in the U.S. included · Unlimited talk and text · Unlimited 5G data · Up to 3GB of domestic high-speed mobile hotspot data. As mentioned before, Straight Talk works on AT&T, T-Mobile and Verizon. But there are specific Straight Talk SIM cards for each of those networks. So no matter. Prepaid Wireless Airtime Card - 1 EA. out of 5 total 15 reviews (15). $ Cancellation/Return Polic Pickup Pickup available. The SIM card-only with “bring your own phone” is sold exclusively at Walmart (Store finder), including the monthly combo plans for 30 days: $ unlimited talk. Straight talk SIM Card will only work with an AT&T or T-mobile compatible or unlocked GSM phone. To activate your service, you will need a. Activate a replacement SIM card: If you don't have the original SIM, you can purchase a new SIM card from avermaster.ru or a retailer. Shop Target for straight talk phone cards you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup plus free shipping on. Straight Talk Mobile · User Icon · Shopping Cart Icon You don't switch your SIM card to a Straight Talk phone that was active within the last 12 months. Call your current carrier to make sure your phone is unlocked & ready to use. Then, verify that your phone is compatible. Check compatibility. Get a Metro SIM. Activate your device with Straight Talk! Choose from phones, tablets, home phones, internet routers, remote alerts, or mobile hotspots. Start now! A T-Mobile SIM card will not work on Straight Talk. SIM cards are locked to their carrier. Straight Talk has the option to switch between an ATT sim card or a T. The correct SIM card will depend on which carrier your phone/tablet is compatible with and on the SIM card size that your phone needs. Ready to activate? Click. If your phone is an Unlocked GSM Phone, or a phone compatible with either AT&T or T-Mobile, you will need a Straight Talk BYOP SIM that is compatible with your. Uses Verizon, AT&T, T-Mobile and Sprint networks for coverage. The SIM card you get determines which network you will use. Service plans start. Find helpful customer reviews and review ratings for Straight Talk Nano SIM Card For T-Mobile Network & Unlocked GSM Phone at avermaster.ru This kit will work with most compatible, unlocked phones so you can turn the phone you love into a prepaid phone. Purchase a service plan and make your wireless. Shop for Straight Talk Wireless cell phones, including no contract, service cards and Straight Talk accessories at avermaster.ru Save money. Live better. In the T-Mobile app, select SHOP, and then Add a line. · On avermaster.ru select Add a person or device to my account. Find the latest phones, no-contract plans, and home internet from Straight Talk with unlimited talk, text, and data on America's most reliable 5G network. Keep the phone. Ditch the contracts · All you need is a SIM card & an unlocked phone · Pick your SIM & plan.

What Price Of House Can You Afford

Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. That's the income from your W-2 (before taxes are removed). Multiply this number by to estimate the maximum value of the home you can afford. However, keep. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. If you want to do a quick calculation, your monthly mortgage payment should ideally be no more than 25% of your gross income. We can help you plan these next. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. Other online calculators use general rules of thumb to estimate how much house you can afford, like "you should never spend more than 43% of your income on a. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. That's the income from your W-2 (before taxes are removed). Multiply this number by to estimate the maximum value of the home you can afford. However, keep. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. If you want to do a quick calculation, your monthly mortgage payment should ideally be no more than 25% of your gross income. We can help you plan these next. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. Other online calculators use general rules of thumb to estimate how much house you can afford, like "you should never spend more than 43% of your income on a. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations.

Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. How much home you can buy depends a lot on your current debt load: Your auto loans, student loans, and credit card minimum payments, for example. Lenders will. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. How Much House can I Afford? If you make a down payment below 20% of the home price, you may be required to purchase Private Mortgage Insurance (PMI). What's. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Want to know how much house you can afford? Use our home affordability Expect a home at this price to fit comfortably within your budget. Your. Your loan amount and down payment will determine how much of a home you can afford, but a lender must first determine how much risk they're willing to take on. However, a 50% debt-to-income ratio isn't going to get you that dream home. Most lenders recommend that your DTI not exceed 43% of your gross income.2 To. Understanding the 28/36 rule for home affordability · You should spend no more than 28% of your monthly income on your housing payment · Your total debts —. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home. If you put less than 20% down on a home, your monthly payment will also include private mortgage insurance (PMI) to help protect the lender in case you stop. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. First, a standard rule for lenders is that your monthly housing payment should not take up more than 28% of your gross monthly income. That way you'll have. How much house can I afford? ; $, Home Price ; $1, Monthly Payment ; 28%. Debt to Income. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your. Knowing your target loan amount will help you determine how much house you can afford. you to buy a house at a more reasonable purchase price with lower. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. If you have significant credit card debt or other. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross.

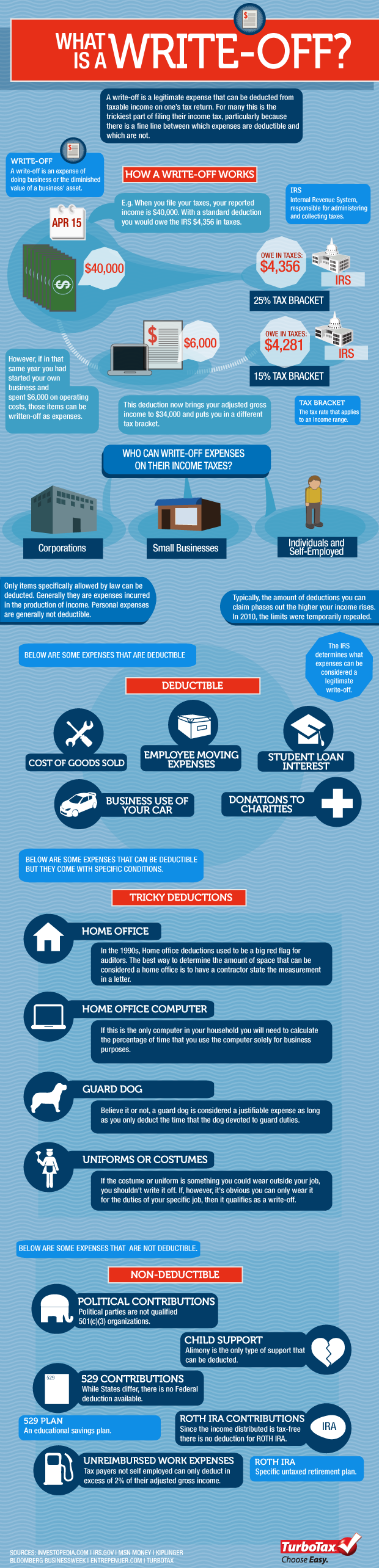

How Does Tax Write Off Work For Donations

If you itemize deductions, gifts of cash to qualified public charities can be deducted in an amount up to 60% of your adjusted gross income (AGI) in a given. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your Goodwill donations. According to the. Your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to. Itemizers can also deduct out-of-pocket expenses paid to do volunteer work for a charitable organization. For example, if you drove to and from volunteer work. I do itemize! What do I need to deduct my donations? You'll generally need records for any tax-deductible donations you made during the relevant tax year. Part B income does not include dividends, capital gains, or interest (other than interest from MA banks). The charitable deduction is limited to 50% of the. In many cases, charitable donations are tax-deductible. When you donate to a qualifying organization, you can deduct the amount from your taxable income if you. To claim a tax-deductible donation, itemize your deductions rather than using the standard deduction. (But, if your standard deduction is more than itemized. In this case, if you donate money to charity, you can count that money as "not income" up to between 20% and 60% of your total income! So in. If you itemize deductions, gifts of cash to qualified public charities can be deducted in an amount up to 60% of your adjusted gross income (AGI) in a given. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your Goodwill donations. According to the. Your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to. Itemizers can also deduct out-of-pocket expenses paid to do volunteer work for a charitable organization. For example, if you drove to and from volunteer work. I do itemize! What do I need to deduct my donations? You'll generally need records for any tax-deductible donations you made during the relevant tax year. Part B income does not include dividends, capital gains, or interest (other than interest from MA banks). The charitable deduction is limited to 50% of the. In many cases, charitable donations are tax-deductible. When you donate to a qualifying organization, you can deduct the amount from your taxable income if you. To claim a tax-deductible donation, itemize your deductions rather than using the standard deduction. (But, if your standard deduction is more than itemized. In this case, if you donate money to charity, you can count that money as "not income" up to between 20% and 60% of your total income! So in.

Itemize deductions · Ensure your contribution is tax-deductible · A contribution is deductible in the year in which it is paid · Rules exist for non-cash donations. Charitable Deductions Limits. How much of a donation is tax deductible? The limit on the deductibility of cash charitable contributions to an eligible Because a contribution to a donor-advised fund (DAF) is a gift to a public charity, donors who contribute to their DAFs are eligible to take a tax deduction in. How do you claim a charitable tax deduction? To claim a tax break for your gifts to charity, you'll fill out your donations in lines of Schedule A. In many cases, charitable donations are tax-deductible. When you donate to a qualifying organization, you can deduct the amount from your taxable income if you. Cash donations are the most straightforward and can be deducted up to 60% of your adjusted gross income (AGI). However, there are different rules for non-cash. Capital gains taxes typically will not apply to you or the charity receiving the donation, and because you didn't write a check, you may have cash available to. A tax-deductible donation is a charitable contribution of money or goods to a qualified, tax-exempt organization, which may reduce the amount of federal income. Assumes donor is in the 37% federal income tax bracket and does not take into account any state or local taxes. Certain federal income tax deductions, including. No, that would be a credit, not a deduction. Charitable donations are an itemized deduction which reduces your taxable income, and indirectly. For example, if you have $25, in taxable income this year and donate 60% of that, or $15,, to charity, you will receive the deduction for the whole gift. These donations allow companies to deduct up to a certain percentage in their taxes, helping them save money that would otherwise go to the government. Why your. Contributions to (c)(3) organizations are tax deductible, meaning that—if you itemize—you can deduct the amount of your donations to (c)(3) nonprofit. The charitable deduction subsidizes charitable giving by lowering the net cost to the donor. If the tax deduction spurs additional giving, charitable. If you itemize your deductions, you may be able to deduct charitable contributions of money or property made to qualified organizations. Only donations actually. Federal law does not allow for charitable donations through payroll deduction (CFC or any other payroll deduction program) to be done pre-tax. Donors who are. Many nonprofit institutions are exempt from paying federal income tax, but taxpayers may deduct donations to organizations set up under Internal Revenue. The charitable deduction subsidizes charitable giving by lowering the net cost to the donor. If the tax deduction spurs additional giving, charitable. They donated to qualified organizations · They are eligible to itemize deductions on their personal tax return · The donations do not exceed the AGI limitation of.

Steps On Becoming A Real Estate Agent

How to become a real estate agent in New York · 1. Finish the salesperson education course · 2. Submit your application · 3. Create an eAccessNY account · 4. Here are the 8 steps you need to take to get a real estate license in Pennsylvania and jump start your new real estate career. Check Eligibility: Ensure you meet state-specific eligibility requirements. · Education: Enroll in and complete a state-approved real estate pre-. 1st STEP is education taken in class, virtual or online offered by Memphis Real Estate School. A real estate agent in Tennessee is issued an affiliate broker. Steps to Become a Real Estate Agent · Step 1: Understand Your State's Real Estate Licensing Requirements · Step 2: Enroll in a Real Estate Pre-Licensing Course. Education and Pre-Licensing Course · Background Check and Fingerprinting · Nevada Real Estate Salesperson Exam · Choosing the Right Broker · Applying for the Real. 7 Steps to Become a Real Estate Agent · 1. Research your state's requirements · 2. Complete pre-licensing education · 3. Pass the pre-licensing final exam. · 4. Becoming a real estate agent in California requires completing pre-license education, passing a real estate licensing exam, and submitting a license. How Do I Get My California Real Estate License? · Step 1: Must be at Least 18 Years of Age · Step 2: Register for and Complete Hours of Required Education. How to become a real estate agent in New York · 1. Finish the salesperson education course · 2. Submit your application · 3. Create an eAccessNY account · 4. Here are the 8 steps you need to take to get a real estate license in Pennsylvania and jump start your new real estate career. Check Eligibility: Ensure you meet state-specific eligibility requirements. · Education: Enroll in and complete a state-approved real estate pre-. 1st STEP is education taken in class, virtual or online offered by Memphis Real Estate School. A real estate agent in Tennessee is issued an affiliate broker. Steps to Become a Real Estate Agent · Step 1: Understand Your State's Real Estate Licensing Requirements · Step 2: Enroll in a Real Estate Pre-Licensing Course. Education and Pre-Licensing Course · Background Check and Fingerprinting · Nevada Real Estate Salesperson Exam · Choosing the Right Broker · Applying for the Real. 7 Steps to Become a Real Estate Agent · 1. Research your state's requirements · 2. Complete pre-licensing education · 3. Pass the pre-licensing final exam. · 4. Becoming a real estate agent in California requires completing pre-license education, passing a real estate licensing exam, and submitting a license. How Do I Get My California Real Estate License? · Step 1: Must be at Least 18 Years of Age · Step 2: Register for and Complete Hours of Required Education.

To become a licensed real estate salesperson (agent) in Idaho, you must complete the mandatory pre-licensing courses, pass a state and national real estate exam. Becoming a real estate agent can be a relatively quick process, often taking just a few short months to complete the necessary training and licensing. Most U.S. states require broker and agent licenses to be renewed every two to four years. Many states also require real estate professionals to attend. How to Become a Real Estate Agent: A Step-by-Step Guide · 1. Research Your State's Requirements · 2. Take a Prelicensing Course · 3. Take the Licensing Exam · 4. Before you can renew your license, you are required to have completed a total of hours of qualifying course hours, and the Legal Update I and II courses. To. Check Eligibility: Ensure you meet state-specific eligibility requirements. · Education: Enroll in and complete a state-approved real estate pre-. To obtain a real estate salesperson license, you must first qualify for and pass a written examination. In addition to a high school diploma or equivalent, the Georgia Real Estate Commission requires that all applicants complete 75 hours of pre-licensing. With all your educational and testing requirements taken care of, your background check complete, and your brokerage in place, you can apply for your real. Basic Requirements on How to Become a Real Estate Agent in Ohio · You must be at least 18 and have a high school diploma or equivalent. · You must be a U.S. To become a real estate agent in Virginia, you'll need to be at least 18 years of age and have a high school diploma or its equivalent. Step 1: Complete the Required Real Estate Education and Exam Prep · Step 2: Pass the Real Estate Licensing Exams · Step 3: Join a Brokerage · Step 4: Apply for. How to Become a Real Estate Agent In GA · 1. Understand the GA Real Estate Requirements: · 2. Understand real estate Pre License course requirements Georgia Real. Becoming a Real Estate Agent · Step 1: Complete your required education · STEP 2: Obtain a sponsoring broker · STEP 3: Complete and Submit the real estate license. Real Estate Salesperson or Broker. Broker. Salesperson. Step 1: Determine if eligible. To become a licensed real estate salesperson you must be at least 5 Steps to Get Your Texas Real Estate License · Pass a Background Check · Complete the Required Pre-Licensing Education · Pass the Pre-License Course Final Exam. Take the required real estate classes. Most states require you to take some classes before you can get licensed. Step 1: Enroll in Arizona Real Estate Classes · Step 2: Complete the Fingerprinting Process · Step 3: Apply to take the Arizona Real Estate Sales Agent Exam · Step. To become a licensed real estate salesperson (agent) in Idaho, you must complete the mandatory pre-licensing courses, pass a state and national real estate exam. This guide covers professional responsibilities and education requirements for both aspiring real estate agents and REALTORS®.

Tax On Passive Investment Income

In the July announcement, the federal government announced some significant changes to the taxation of passive income within corporations. An S corporation with accumulated earnings and profits that also has passive investment income totaling more than 25 percent of gross receipts is subject to an. Passive income is money you bring in without actively and regularly working for it. · The Internal Revenue Service (IRS) has specific rules for passive income. Except as otherwise provided in this section, there is hereby imposed a tax on passive investment income attributable to California sources, determined in. (2) The term "net passive income" means passive investment income, reduced by the deductions allowable under this chapter which are directly connected with the. The tax is imposed at the rate prescribed by section , subdivision 1. The terms "subchapter C earnings and profits," "passive investment income," and ". 26 USC Tax imposed when passive investment income of corporation having accumulated earnings and profits exceeds 25 percent of gross receipts. Passive Investment Income Tax. (1) Definitions -. (a) "Passive investment income" means gross receipts from royalties, rents, dividends. The SBD results in a lower rate of tax on active business income earned by a corporation and creates an opportunity for tax deferral. The rules that restrict. In the July announcement, the federal government announced some significant changes to the taxation of passive income within corporations. An S corporation with accumulated earnings and profits that also has passive investment income totaling more than 25 percent of gross receipts is subject to an. Passive income is money you bring in without actively and regularly working for it. · The Internal Revenue Service (IRS) has specific rules for passive income. Except as otherwise provided in this section, there is hereby imposed a tax on passive investment income attributable to California sources, determined in. (2) The term "net passive income" means passive investment income, reduced by the deductions allowable under this chapter which are directly connected with the. The tax is imposed at the rate prescribed by section , subdivision 1. The terms "subchapter C earnings and profits," "passive investment income," and ". 26 USC Tax imposed when passive investment income of corporation having accumulated earnings and profits exceeds 25 percent of gross receipts. Passive Investment Income Tax. (1) Definitions -. (a) "Passive investment income" means gross receipts from royalties, rents, dividends. The SBD results in a lower rate of tax on active business income earned by a corporation and creates an opportunity for tax deferral. The rules that restrict.

Passive income, as an acquired income, is taxable. Examples of passive income include rental income and business activities in which the earner does not. A more accurate term is “excess net investment income.” The ENPI tax is assessed at the maximum corporate tax rate as provided under. IRC Section (a). The. Income Tax return, including any extensions. In Column C, enter amounts from Column B that are not capital gains or losses or passive investment income or. The investors in these tax shelters would use their paper losses to offset their other real income. In addition, passive income does not include investment or. Passive investment income is gross receipts from royalties, rents, dividends, annuities, and interest (excluding interest on installment sales of inventory to. Passive activity loss rules are a set of tax regulations that prohibit taxpayers from using passive losses to offset earned or ordinary income. Under the passive activity rules you can deduct up to $25, in passive losses against your ordinary income (W-2 wages) if your modified adjusted gross income. § Tax imposed when passive investment income of corporation having subchapter C earnings and profits exceed 25 percent of gross receipts. (a) General. Shareholders in S-corporation financial institutions increasingly have been faced with the net investment income tax (NIIT) created by the Patient. Passive investment income is gross receipts derived from royalties, rents from residential property or farm property, dividends, interest, annuities, and the. Key Takeaways · Passive income is money you bring in without actively and regularly working for it. · The Internal Revenue Service (IRS) has specific rules for. Investment or passive income, earned by a corporation would be taxed at a much higher rate than ABI above or below the SBD. In addition, that passive income can. [21] Section (g)(3) imposes for each taxable year on the income of each electing partnership a tax equal to percent of such partnership's gross. Long-term capital gains and qualified dividends are generally taxed at special capital gains tax rates of 0 percent, 15 percent, and 20 percent depending on. It has Passive Investment Income for the tax year that is in excess of 25% of Gross Receipts. This includes Portfolio Income from Schedule K which is considered. Earning corporate passive income reduces amount of active income eligible for passive investment income earnings. Page 8. Disclaimer. This article is. Passive investment income may include interest income, foreign dividend income, rental income, royalty income and taxable capital gains. This is the case. Also, gain or loss from the disposition of property that produces these types of income or that is held for investment is not passive income. Personal service. Overview · The passive investment income tax may be imposed directly on an S corporation's income, or portion thereof. · The so-called LIFO recapture tax is not. A tax on the lesser of an S corporation's net income or excess passive investment income, if certain conditions are met. Sign up Today! Join our mailing list.

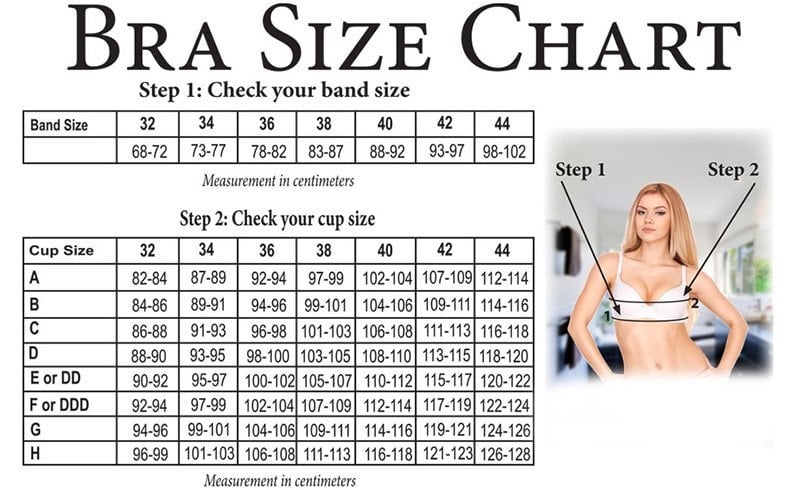

What Is A 34e Bra Size Equivalent To

Find everything you need to know to convert your bra size internationally, alongside UK bra sizing and bra fitting 34E, 34DDD, 75F, 90F. 34F, 34G, 75G, 90G. Use our handy size conversion chart to convert any bra size into your Australian size. 34E, 75F, 90F. 12F, 34F, 34F, 75G, 90G. 12G, 34G, 34G, 75H, 90H. 14A. SISTER SIZE CHARTS: ; 30 BAND SIZE · 30AA, 28A ; 32 BAND SIZE · 32AA, 30A ; 34 BAND SIZE · 34AA, 32A ; 36 BAND SIZE · 36AA, 34A ; 38 BAND SIZE · 38AA, 36A. Freya lingerie and swimwear uses UK underband and cup sizing. The size chart below outlines both UK and international sizing conversion so you can always be. International Bra Size Converter - Convert bra sizes between different bra sizing (34E), 75F, 34E, 90F, 2F, 12E. 34F, 75G, 34F, 90G, 2G, 12F. 34G, 75H, 34G. Are you wearing the correct US bra size? Measure in inches or centimeters and verify with accurate sizing tables. Includes large sizes, up to T-cup. Bra Size Conversion Chart – Your Size in Make Bra ; 32DD/E · 32DDD/F · 32G. As a guide, a 28 back is a US size 4, 30 back is a size 6, 32 is a size 8, 34 a size 10, 36 a size 12 and 38 a size 14, so if you're a US size 8 and wearing a. Measuring in at 28G, my sister sizes would be 30FF > 32F > 34E. With this in mind I know that if a particular brand comes up tight in the band, I can choose a. Find everything you need to know to convert your bra size internationally, alongside UK bra sizing and bra fitting 34E, 34DDD, 75F, 90F. 34F, 34G, 75G, 90G. Use our handy size conversion chart to convert any bra size into your Australian size. 34E, 75F, 90F. 12F, 34F, 34F, 75G, 90G. 12G, 34G, 34G, 75H, 90H. 14A. SISTER SIZE CHARTS: ; 30 BAND SIZE · 30AA, 28A ; 32 BAND SIZE · 32AA, 30A ; 34 BAND SIZE · 34AA, 32A ; 36 BAND SIZE · 36AA, 34A ; 38 BAND SIZE · 38AA, 36A. Freya lingerie and swimwear uses UK underband and cup sizing. The size chart below outlines both UK and international sizing conversion so you can always be. International Bra Size Converter - Convert bra sizes between different bra sizing (34E), 75F, 34E, 90F, 2F, 12E. 34F, 75G, 34F, 90G, 2G, 12F. 34G, 75H, 34G. Are you wearing the correct US bra size? Measure in inches or centimeters and verify with accurate sizing tables. Includes large sizes, up to T-cup. Bra Size Conversion Chart – Your Size in Make Bra ; 32DD/E · 32DDD/F · 32G. As a guide, a 28 back is a US size 4, 30 back is a size 6, 32 is a size 8, 34 a size 10, 36 a size 12 and 38 a size 14, so if you're a US size 8 and wearing a. Measuring in at 28G, my sister sizes would be 30FF > 32F > 34E. With this in mind I know that if a particular brand comes up tight in the band, I can choose a.

Bra Sister Size Size Comparison Chart: ; 32C. 34B. 36A ; 32D. 34C. 36B ; 32DD. 34D. 36C ; 32DDD. 34DD. 36D. Sister bra sizes are alternate sizes where the cup volume stays the same even though the band size and cup letter change. Simply find the size you wear in your native country and our international bra size converter will tell you what size you need to look at when buying bras in. A: Thank you for contacting Chantelle. A 34E is the same as 34DD US. A manufacturer. Manufacturer · 7 years. Our Best Sellers ; 12D · 34D · 34D ; 12DD · 34DD · 34DD ; 12E · 34E · 34DDD ; 12F · 34F · 34F. A bra sister size maintains cup capacity while adjusting the tightness of the band, leading to a better fit in some instances. Use the charts below to convert your regular bra size into Nike Sports Bra sizes. 34D - 34E 36A - 36C, 36D - 36E 38A - 38C, 38D - 38E 40A - 40C, 40D - 40E. Bras conversion chart ; 34DD, 34DD/E · 75E ; 34E, 34DDD/F · 75F ; 34F, 34G, 75G ; 34FF, 34H, 75H. For example, an 85B bra size and an XS bra size are equivalent. Please note 2D. 90E; 75E; 34DD; 34DD/E; 2DD. 90F; 75F; 34E; 34DDD/F; 2E. 90G; 75G; 34F; 34G. First of all, I live in the US so I'm going to talk about US sizing. A lingerie fitting associate told me that for every D, you add a letter. A 34DD=34E. Measure your overbust to determine your cup size. Find your band size chart below and choose from the ranges for your bra size. They are your “bra size equivalent”. Having more than one option to try on can be helpful to find the perfect fit and ensure you are getting a bra that is. International Bra Size Conversion Chart ; 12D, 34D, 34DD ; 12DD, 34DD, 34E ; 12E, 34DDD/E · 34F ; 12F, 34F, 34G. Aimerfeel's Bra Conversion Chart ; ", 95 cm, 34D ; ", 98 cm, 34E/DD. Women's Bra Size Conversion Chart ; M · 34E, 75E ; L · 36A, 80A ; L · 36B, 80B ; L · 36C, 80C. Women's Bra Size Conversion Chart ; M · 34E, 75E ; L · 36A, 80A ; L · 36B, 80B ; L · 36C, 80C. Bra Cup Sizes vs. Band Size. ㅤ. There are two primary components of bra sizes 34E, 34F, 34G, 34H, 36A, 36A½, 36B, 36B½, 36C, 36C½, 36D, 36E, 36F, 36G, 36H. 30FF, 32F, 34E, 36DD, 38D, 40C, 42B, 44A, 46AA. 26H, 28GG, 30G It is not recommended to wear a bra any more than one sister size away from your ideal bra size. Bras ; 34DD, 34DD, 34E, 75F, 90F ; 34DD/E · 34DD/E · 34F, 75G, 90G. Bras ; 34DD, 34DD, 34E, 75F, 90F ; 34DD/E · 34DD/E · 34F, 75G, 90G.